5 Mar, 2019

General Market Thoughts and Trade Plan Continued 3/5/2019

All,

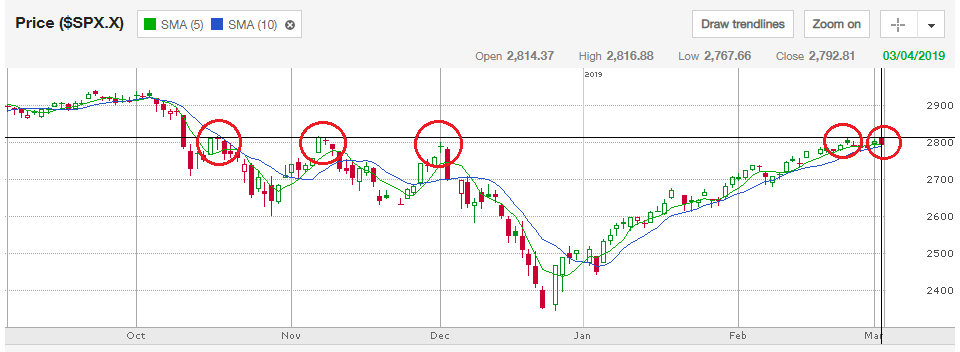

The market is teetering in a very awkward spot. Check out this chart of the SPX and notice that the double-top is right at the line where we’ve previously stopped. This is a perfect example of how a previous peak becomes resistance:

The IWM shows a different pattern. Note that there aren’t crisp peaks at resistance, but rather, lower peaks and then a test of resistance from last week:

We won’t sit here forever and either the buyers or sellers will begin to win this tug-of-war. I can’t justify going long in anything here because there is no momentum upwards. We need to get out of this stall before we can really make a wise decision.

Another note: One could justify going short here. The VIX is at a low point and UVXY will shoot up if there is an abrupt downturn in the market. My word of warning is that everyone and their brother can see that we are at a very established resistance on the SPX. While I think there are some bearish signs, I think that we move sideways for a bit longer before something happens. I don’t expect an excessive drop in the market because when everyone is expecting a drop, the sustained affect will be somewhat dampened.

As I stare at this, I’m not ready to go short yet because a sustained sideways move will not be profitable. I’m going to sit on the sidelines until tomorrow afternoon and I’ll keep watching to see if the market chooses a direction.

Leave a Reply